Global Equities Rally, Fed Independence in Focus, and the Euro at a Crossroads

Market Overview: Tech Surge and AI Optimism Fuel Rally

Global equity markets extended gains as optimism around artificial intelligence reignited risk appetite. Technology stocks were at the forefront of the rally, with the Nasdaq 100 futures climbing for a fifth straight session and Europe’s Stoxx 600 advancing 0.7%, led by a tech sector surge. In Asia, chipmakers drove equities to new monthly highs, pushing the MSCI global index into fresh territory.

OpenAI’s valuation skyrocketed to $500 billion following a major secondary share sale worth $6.6 billion, lifting sentiment across the tech space. New chip supply agreements with South Korean firms further bolstered confidence in AI’s growth trajectory. This tech-driven optimism comes despite a lingering U.S. government shutdown and a pause in official economic data flow.

Macro Focus: Jobs Market Weakness and Data Delays

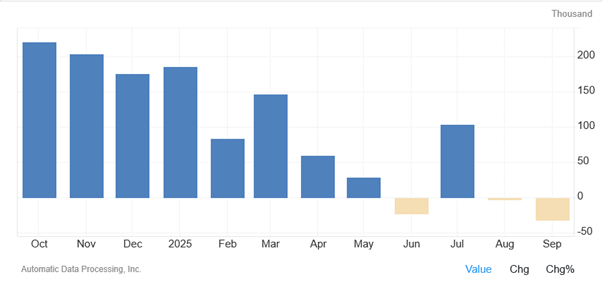

ADP data released midweek revealed an unexpected drop in U.S. private-sector payrolls for September, reinforcing a cooling trend in the labor market. Wage growth also decelerated—job switchers saw only a 6.6% annual increase, the weakest in a year, while those staying in their roles experienced a 4.5% gain.

The Trump administration has postponed the official September jobs report due to the ongoing shutdown, intensifying concerns over data reliability and potential political interference. Notably, President Trump’s controversial nominee for the Bureau of Labor Statistics recently withdrew after media scrutiny.

Despite these concerns, the equity market remains resilient. U.S. stocks hit new records, partly on expectations that the Federal Reserve may soon resume cutting rates. Treasury yields remained steady, with 10-year notes hovering around 4.10%.

Fed Independence: Supreme Court Sides Against Trump—For Now

In a significant development for central bank independence, the U.S. Supreme Court temporarily blocked President Trump’s attempt to remove Federal Reserve Governor Lisa Cook. The court will hear the case in January, but Cook will remain in her role until then.

The legal challenge has far-reaching implications, not only for the Federal Reserve’s operational autonomy but also for broader institutional stability. The outcome could influence upcoming Fed decisions, including those on interest rates at meetings scheduled for October, December, and January.

Currency Market: Euro Struggles at $1.18 Resistance

The euro remains trapped below the key $1.18 level, a resistance that has held firm since July. While clearing this level could open the path to $1.20, the euro’s elevated valuation on a real-effective exchange rate basis—now the most expensive among G10 currencies—has deterred bullish momentum.

With peers like the yen and Norwegian krone trading at a discount, capital flows have shifted, causing the euro to underperform in Q3. Options markets reflect a 75% probability that EUR/USD will remain in a $1.15–$1.20 range through year-end, with potential downside if growth fails to surprise or if the European Central Bank remains dovish.

Commodities & Other Markets

- Gold extended its rally to $3,874.64 per ounce, continuing to benefit from both macro uncertainty and expectations of monetary easing.

- Brent Crude ticked higher to $65.46 a barrel.

- Cryptocurrencies also gained, with Bitcoin up 0.9% to $118,687 and Ether rising 1.3% to $4,394.

- Currency Moves: The Bloomberg Dollar Spot Index remained flat, while the euro rose 0.1% to $1.1748. The pound gained modestly to $1.3495.

Looking Ahead

The market awaits further clarity on:

- The Supreme Court’s upcoming decision on Lisa Cook’s tenure at the Fed.

- The resumption of official U.S. labor data and its implications for monetary policy.

- Continued developments in AI and tech earnings.

- Market reactions to the prolonged U.S. government shutdown and its potential economic effects.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.