PPI in focus, yields slide, UK growth surprises, geopolitics in play

Markets open today balancing three forces: the US producer-price print, a persistent bond rally tied to imminent Fed easing, and headline risk from US-Russia-Ukraine diplomacy. Risk assets are pausing after a strong run, while rates markets lean into a September Fed cut.

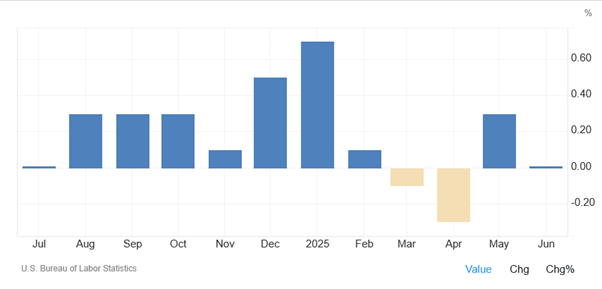

United States: PPI and market setup (lead)

- PPI today; retail sales Friday. Equities are catching their breath after back-to-back S&P 500 records, with futures little changed ahead of PPI. Retail sales tomorrow will add a read on consumer momentum.

- Rates backdrop. Treasuries extend gains into the release: 10-year yields hover near ~4.22%. Traders fully price a 25 bp September cut, with some debate about a larger move if data weaken further. Weekly jobless claims are also due.

Trading lens: A hotter-than-expected PPI risks reviving “50 vs 25” chatter and flattening the front end; a soft print would validate the bond rally and keep equities supported into retail sales.

Rates: Front-end leadership, Fed path

- Two-year yields are near the lowest since May (~3.67%), down ~30 bps since late July as markets shifted decisively toward a September cut. The 10-year has eased ~15 bps over the same span.

- The dovish swing followed softer payrolls; today’s PPI/claims act as the next validation (or challenge) to that path.

Equities: Rally pauses

- US: S&P 500 and Nasdaq 100 futures are flat after record closes; positioning feels fuller into data.

- Europe/Asia: Europe’s Stoxx 600 +0.3%; Asia eased after a four-year high Wednesday as investors de-risk ahead of US prints.

FX: BOJ watch lifts JPY, GBP firmer on data

- JPY outperforms after remarks from US Treasury signaled expectations for Japan to raise rates to tame inflation; that nudged rate differentials modestly in yen’s favor.

- GBP edges up as UK growth beats, trimming BOE-cut bets at the margin.

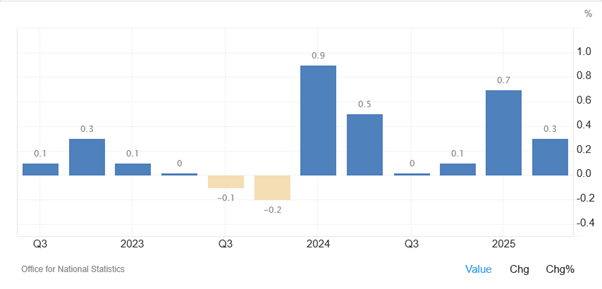

Europe: UK growth tops G-7 in H1, BOE path murkier

- UK GDP: Q2 +0.3% q/q (vs +0.1% forecast). June output +0.4%, doubling expectations. The UK posted the fastest G-7 growth in H1.

- Drivers & mix: Public spending and inventories offset softer consumer spending and weaker business investment. Traders trimmed BOE easing expectations; the pound ticked higher.

Takeaway: Growth support is coming from the public sector; with inflation still sticky, the bar for aggressive BOE cuts rose a notch.

Geopolitics: Trump, Putin, and the Alaska Summit

- Ahead of Friday’s meeting, the White House warned of “very severe consequences” absent a ceasefire, after a call with European leaders. A quick trilateral meeting with Zelenskiy is being pushed, with Turkey floated as a venue. Territorial concessions were ruled out by allies; security guarantees remain a focal point.

- Headline risk remains two-sided for defense, energy sentiment, and haven flows into weekend risk.

Commodities and crypto

- Brent +0.3% ($65.8); Gold −0.4% ($3,343) as real yields drift lower but pre-PPI caution caps the move.

- Bitcoin/Ether mixed, consolidating after recent gains.

Corporate highlights (selected)

- Adyen guided that acceleration in net revenue growth this year is unlikely amid trade-war macro drag; shares fell.

- Swiss Re H1 profit beat; Carlsberg narrowed FY guidance to the upper end; Apple preps an AI-heavy device slate (including a smarter Siri and home devices).

- Thyssenkrupp cut guidance on weak demand; Hon Hai earnings rose on AI demand resilience; Greggs faces elevated short interest; Standard Bank delivered record H1 profit.

Today’s watchlist

- US: PPI (core & headline), weekly jobless claims; Friday: retail sales. Positioning is sensitive at the front end; watch two-year leads and equity breadth into tomorrow’s consumer read.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.