Fed Poised to Cut Rates and End QT Amid Rising Risks

All eyes are on the Federal Reserve’s October 28–29 meeting, where policymakers are widely expected to cut interest rates by 25 basis points. The move, however, may be accompanied by another significant shift — the possible end of Quantitative Tightening (QT). With U.S. government operations still partially shut and key data unavailable, the Fed is expected to lean heavily on risk management, prioritizing financial stability and liquidity over continued tightening.

Policy Decision Preview

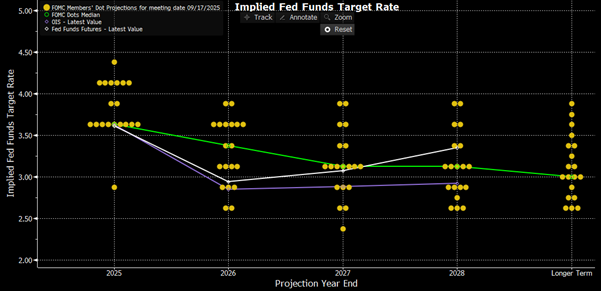

The federal funds rate is projected to move down to a target range of 3.75%–4.00%, marking the second rate cut this year. The policy statement will likely acknowledge that economic activity remains solid, even as inflation pressures have moderated slightly.

At the same time, the Fed is expected to announce the end of its balance sheet runoff, halting Treasury redemptions that had been capped at $5 billion per month. Proceeds from maturing Treasuries will now be reinvested in short-term Treasury bills, before gradually being distributed across maturities to mirror the composition of the U.S. Treasury market.

This shift signals the Fed’s recognition that liquidity conditions have tightened meaningfully in recent weeks — a sign that bank reserves have transitioned from “abundant” to merely “ample.”

Liquidity and Market Dynamics

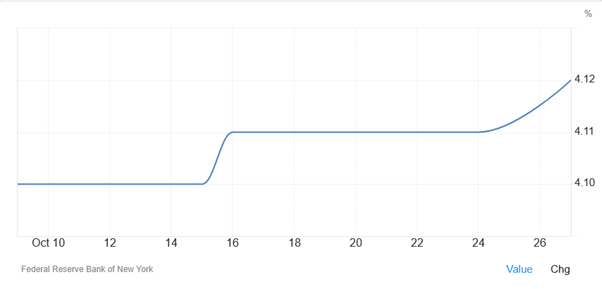

Evidence of tightening liquidity has been mounting since mid-October:

- Standing Repo Facility (SRF) usage has become persistent, indicating that institutions are regularly tapping the Fed for short-term funding.

- The effective federal funds rate (EFFR) has been trading above the interest on reserve balances (IORB), showing upward pressure in money markets.

- Short-term benchmarks such as SOFR and the Tri-Party General Collateral Rate (TGCR) have also risen above the IORB, further confirming reduced liquidity.

These shifts resemble early signs of the 2019 funding squeeze, and the Fed appears determined to avoid a repeat. Ending QT now would act as a preventive measure to preserve smooth functioning in funding markets.

Diverging Views Inside the Fed

The policy consensus is far from unanimous.

- Governor Stephen Miran is expected to dissent again, pushing for a larger 50-basis-point cut to pre-empt potential labor market stress.

- Governor Michelle Bowman, on the other hand, is likely to oppose halting QT, emphasizing the importance of continuing balance sheet normalization.

This highlights the Fed’s internal divide between risk management and inflation vigilance, especially as recent inflation data — although softer — remains above the 2% target, with core prices still up about 3% year over year.

Economic and Political Backdrop

The backdrop to this meeting is highly unusual. The U.S. government shutdown has delayed the release of key indicators such as October CPI and unemployment data, forcing policymakers to make decisions with limited visibility.

Meanwhile, renewed tariff threats on China and Canada have injected fresh uncertainty into the inflation outlook. These factors, combined with signs of slower hiring and wage growth, are tilting the Fed toward a more cautious stance through year-end.

Outlook Beyond October

If the Fed follows through with both a rate cut and the end of QT, it will likely maintain a “nimble” stance heading into the December 9–10 meeting. Without official inflation or jobs data before then, alternative indicators — such as private payroll measures and real-time wage trackers — will shape the policy debate. Should those indicators show further labor market weakness, another 25-basis-point cut in December remains plausible.

The bottom line: The Fed appears to be choosing the path of least resistance — easing modestly now to manage risks rather than waiting for visible damage to appear. This marks a transition from a tightening cycle driven by inflation concerns to one dominated by financial stability and employment risks.

Market Implications

- Treasuries: Yields are likely to stay under downward pressure, with the 2-year note most sensitive to policy expectations.

- U.S. Dollar: The greenback could soften further as markets price in an extended easing path.

- Equities: Risk assets may initially welcome the move, but investors will soon refocus on growth signals and the depth of the slowdown.

- Commodities: A weaker dollar and lower yields could provide short-term support to gold and silver, though long-term direction will depend on how much confidence the market retains in the Fed’s inflation control.

The upcoming FOMC decision underscores the Fed’s shift toward a defensive posture — cutting rates and ending QT not because of a crisis, but to prevent one. With fiscal policy uncertain, data visibility limited, and liquidity under strain, the Fed is signaling flexibility and caution. Markets will interpret this as an acknowledgment that the balance between inflation and growth risks has finally tilted toward the latter.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.