CPI sets the tone, tariffs in the backdrop

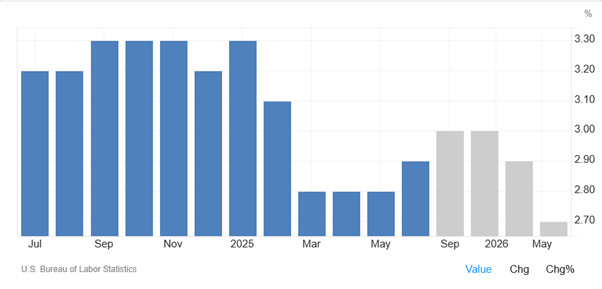

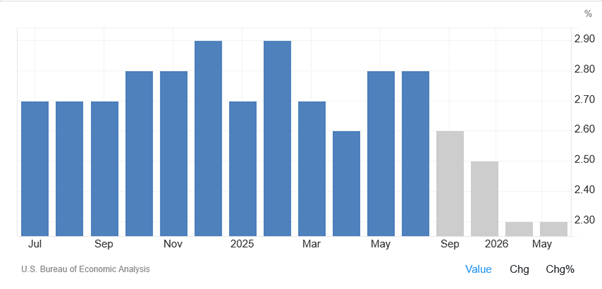

Markets are marking time ahead of today’s US CPI print, with rates, equities, and the dollar largely range-bound as investors reassess how much tariff pass-through and services pricing will show up in July’s data, and what that means for the September FOMC.

United States: CPI preview (today)

- What to watch: Consensus looks for core CPI +0.3% m/m in July (fastest since January) with headline around +0.2–0.3% m/m. The composition likely skews hotter on services (airfares/hotels stabilizing higher) and less deflation from autos, while the tariff impulse persists but appears to be slowing versus June in several goods categories. If realized, this leans against the notion of an easy September cut.

- Mechanics under the hood: Bloomberg Economics’ work suggests tariff-exposed categories like some apparel lines may still firm, but major appliances, PCs, audio, furniture likely saw slower price acceleration in July than in June. Housing components should keep easing at the margin (rent and OER moderating).

- Policy read-through: With core PCE (Aug 29) potentially printing even firmer than CPI, a September cut is not a done deal despite market pricing leaning that way.

Market positioning into CPI

- Futures & rates: S&P 500 and Nasdaq-100 futures are little changed; the 10-year UST ~4.28% with muted price action. Gold ticks higher. Markets have >2 cuts priced by December, with roughly 80% odds of a September move — vulnerable if core runs hot.

- Cross-asset snapshot: Europe’s Stoxx 600 +0.2% (defense leading). Dollar broadly flat; EUR steady, JPY softer; oil steady; Bitcoin/Ether mixed.

Policy, trade and tech: What’s moving the narrative

- Tariffs/truce: A 90-day extension of the US-China trade truce sustains uncertainty and the risk of inflation persistence even as goods disinflation fades. That keeps the stagflation debate alive if growth cools while prices stay sticky.

- China chips: Reports that Chinese authorities urged local firms to avoid Nvidia’s H20 in certain (especially government-adjacent) uses complicate the company’s China revenue recovery and add a wrinkle to the policy-tech nexus.

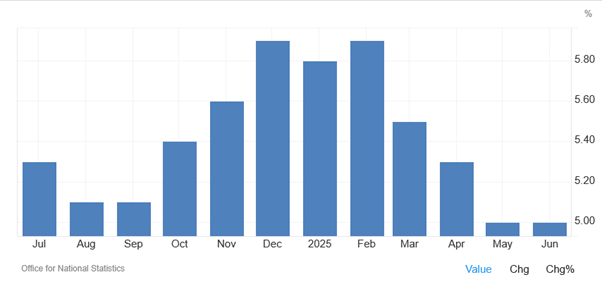

Europe/UK: Labor and rates

- UK jobs surprise: July payrolls fell by 8,353 — a smaller decline than expected — with recent months revised to show fewer losses. Unemployment held at 7%; private-sector pay ex-bonus eased to 4.8%; vacancies at 718k and inactivity edged lower. The milder deterioration complicates the BOE’s path after last week’s close vote to cut, especially with inflation re-firming.

- Market tone: Gilts bear-steepen modestly around the edges; UK 10-year yield higher on the day alongside the firmer jobs tone.

US corporate and single-name highlights

- Platform policies: Elon Musk criticized Apple’s App Store practices, alleging preferential treatment, a reminder that platform rules can swing monetization narratives for large apps/services.

- Healthcare deal-making: Bayer agreed to pay up to $1.3B to partner with Kumquat Biosciences on an oncology candidate, bolstering its pipeline.

- Textiles consolidation: Hanesbrands spiked after reports Gildan is nearing an acquisition deal.

- Banking flow: An institutional holder sold a CHF ~503m stake in UBS, taking advantage of strength in the shares.

Today’s setup: What matters for trades

- CPI internals > headline: Watch core services ex-shelter, used/new autos, airfares/hotels. A re-acceleration here matters more for the Fed reaction function than a gas-led soft headline.

- Tariff transmission: If July shows broader but slower pass-through than June, that argues for a grind-higher inflation path rather than a spike — enough to question aggressive easing timelines.

- Rates market asymmetry: With September largely priced, upside surprise in core risks cheapening duration and risk-off in high-beta tech; downside surprise re-opens soft-landing.

- UK follow-through: A steadier UK labor backdrop reduces the urgency to cut again near-term; watch Thursday’s GDP (Q2) for confirmation.

Quick market rundown (as of Europe AM)

- Equities: Stoxx 600 +0.2%; US futures flat.

- Rates: UST 10-year ~4.28%; Bund 10-year ~2.70%; Gilt 10-year ~4.59%.

- FX/Crypto: USD flat; EUR steady, JPY softer; Bitcoin/Ether mixed.

- Commodities: Brent little changed; gold firmer.

A 0.3% m/m core risks pushing back against an automatic September cut and keeps the focus on services prices rather than a one-off goods rebound. With tariffs sustaining a slow-burning inflation floor and labor showing resilience in the UK, the policy path remains data-dependent and uneven across regions. Positioning is light into the print; volatility likely expands with the CPI internals.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.