CPI in focus as tariffs bite; chips, crypto & geopolitics in the mix

Markets start the week balancing three live forces: (1) US inflation that’s edging up as tariff effects filter through retail prices, (2) an unusual chip-policy deal that could ripple across tech supply chains, and (3) heavy crypto bid alongside headline-driven swings in risk sentiment. Tuesday’s CPI is the main event, while policy and geopolitics (US-China trade truce deadline; Ukraine diplomacy) color the backdrop.

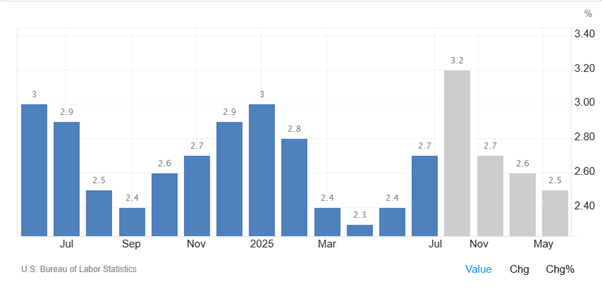

United States: CPI Preview (Tue, Aug 12)

- Core CPI: Consensus points to +0.3% m/m in July (largest monthly gain YTD), up from +0.2% in June. Headline CPI likely soft at +0.2% m/m as cheaper gasoline offsets some pressure. The mix underscores a modest re-acceleration in underlying inflation.

- Tariff pass-through: Higher US import duties are gradually lifting goods prices (e.g., household furnishings, recreational goods), while core services remain comparatively tame for now. The inflation impulse from tariffs is still working its way through.

- Fed lens: Policymakers have stayed on hold to gauge the durability of tariff-driven inflation while a cooler labor market adds a growth trade-off to the reaction function.

- Spending pulse: Retail sales (Fri) are expected to show a solid print, helped by auto incentives and Prime Day demand — but underlying real spending remains unexciting.

- Production: Fed data this week likely signal stagnant factory output as firms adapt to the evolving tariff regime.

- Trade truce clock: The US-China 90-day truce expires Tue, Aug 12; an extension is still possible and would be read as de-escalatory for near-term price risks.

Policy and geopolitics: A new chip playbook

- NVDA/AMD deal: Nvidia and AMD have agreed to remit 15% of revenue from certain AI-chip sales to China to the US government in exchange for export licenses, a novel arrangement that raises legal and policy questions and may set a template for other sectors.

- Controls context: After prior restrictions pushed Nvidia to design the H20 around earlier rules, export controls were tightened in April, requiring permits; more recently, Washington allowed sales of lower-spec chips tailored for China.

- China’s stance & demand: Beijing-linked commentary flagged security concerns over H20, yet local supply shortfalls mean Chinese firms may still buy, a potential volume tailwind (and, via the deal structure, US fiscal intake).

- Market impact: In pre-market trade, NVDA −1.6% / AMD −2.4% as investors price the policy overhang.

Crypto: Near highs as institutional bid builds

Bitcoin pushed to within striking distance of its all-time high, topping $122,000 intraday over the weekend; Ether briefly cleared $4,300. The move remains underpinned by institutional/treasury accumulation (BTC treasury stockpiles near $113B; ETH around $13B via listed vehicles), alongside constructive derivatives positioning.

Other movers: Themes to watch

- Ukraine diplomacy: Early optimism about a Trump–Putin meeting in Alaska on Friday faded, tempering the risk rally; markets are treating Tuesday’s CPI as the heavier catalyst.

- Battery chain: Lithium prices/stocks spiked after a major CATL-linked mine halt in China — another reminder of supply-chain sensitivity to idiosyncratic shocks.

- Switzerland trade shock: After a 39% US tariff, early data this week may show Q2 contraction, with Bern–Washington talks being watched for any thaw.

The week ahead: My checklist

- Tue, Aug 12: US CPI (July) — tariff pass-through vs. gasoline drag; watch core goods vs. core services splits.

- Tue, Aug 12: US–China trade truce deadline — extension would reduce escalation risk; lapse would keep the tariff channel warm.

- Fri: Trump–Putin Alaska meeting (headline risk) — any cease-fire signals vs. stalemate.

Positioning thoughts: concise, non-advisory

- Rates: A 0.3% core CPI print likely keeps the Fed patient; belly and breakevens sensitive to goods-price lines.

- Equities: Policy-path uncertainty in chips argues for higher idiosyncratic dispersion across AI hardware names near-term.

- FX: With US CPI the swing factor and geopolitics two-way, expect range-bound DXY until data break the tie.

- Crypto: Momentum is intact as spot levels press prior highs; macro sensitivity rises around CPI and any tariff headlines.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.