US jobs report in the spotlight

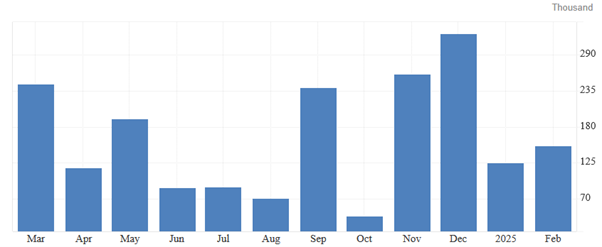

Market participants are paying close attention to the upcoming US employment data, which is expected to show solid nonfarm payroll gains for March while possibly signaling a slight uptick in the unemployment rate. Early estimates point to a noticeable rebound in job creation compared to the previous month, influenced in part by temporary factors such as improved weather conditions and the resumption of certain government spending. Additionally, the push by businesses to stock up on goods ahead of newly announced import tariffs may have boosted trade and transport hiring in March.

Despite a likely headline increase in employment, the expected rise in the jobless rate suggests that underlying economic dynamics could be changing. Some observers note that profit margins may be squeezed if firms cannot fully pass through tariff-related costs, potentially pressuring companies’ future hiring plans. If labor market data eventually indicate more significant slowing, it may shape the debate on whether further shifts in monetary policy become necessary later in the year.

Stocks slide as global tensions build

Equity markets have extended their losses this week, with major US stock indexes experiencing substantial declines in recent sessions. Heightened trade tensions and associated tariff measures have fed concerns about slower economic growth, prompting a search for relative safety in government bonds. As a result, long-dated Treasury yields have dropped sharply, reflecting increased expectations for potential rate cuts to counter a cooling economy.

Globally, major equity benchmarks are on track for one of their worst weekly performances in several months. Worries that reciprocal tariffs will dampen international trade and corporate earnings have contributed to a risk-off tone across multiple sectors, including technology, manufacturing, and consumer goods.

Oil drops to multi-year lows

Energy markets were also shaken by a steep drop in oil prices. A combination of newly announced tariffs, which may reduce energy demand, and an unexpected increase in production quotas from a leading producer alliance, weighed heavily on crude. Prices for key benchmarks have slipped to levels not seen in more than three years, forcing traders and market watchers to reevaluate forecasts for the remainder of 2025. While some anticipate that potential supply disruptions could offer temporary support, the near-term picture is dominated by worries about oversupply and weaker economic growth.

Looking ahead

US labor data: The biggest immediate focus is the US jobs report, which will clarify whether job growth is robust enough to maintain consumer momentum despite rising economic headwinds. Any unexpected weakness—especially in wage gains—could heighten market volatility.

Trade and tariffs: As new tariff measures take shape, markets remain vulnerable to updates on retaliatory actions from international trading partners. This is shaping both business sentiment and investment flows.

Oil market balance: With crude prices hitting multi-year lows, further developments around production policy and the potential for supply disruptions will be watched closely. Traders are determining whether this downturn in oil is short-lived or signals a prolonged period of lower prices.

Bond market signals: The ongoing rally in Treasuries highlights investor demand for perceived safe-haven assets. If upcoming data reinforce fears of a more pronounced economic slowdown, yields could continue to slide and prompt discussions about future monetary easing steps.

Overall, the US labor figures are the pivotal event in the near term, setting the tone for how investors interpret economic signals amid trade frictions and signs of moderating global growth. While equity and commodity markets face headwinds, incoming data may provide further clues about the trajectory of both consumer demand and corporate activity in the coming months.

Prepared by Nour Hammoury, Chief Market Analyst at SquaredFinancial

Nour is an investor, independent market strategist, and financial advisor. He holds a BA in Finance and Banking Science from Al-Ahliyya Amman University and a CFTe in Economics from the International Federation of Technical Analysts. He has more than 15 years of experience in forex, stocks, and global economic developments, as well as central bank policies and intermarket analysis. He appears regularly on major international TV networks, such as BBC, Al-Jazeera, Al Hurra, CNBC, and Bloomberg, holding open discussions and sharing insights and readings of the markets and trends.

Disclaimer

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The information contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. Squared Financial makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on a recommendation, forecast, or other information supplied by Squared Financial.

The information on this site is not intended for any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.